1. Trust is important, but always make sure to secure your payment

Selecting the most suitable method of payment is a key factor of a successful export sale. Whichever payment method you select, you should always sign a contract of sale before performing any international transaction. Basically, all methods of payment can be classified as either ‘clean’ or ‘documentary’. In clean payments there is no payment security, except for in advance payment. In documentary payments, a level of security is achieved using the banking system and accompanying documents. The following methods of payment are used:

- Payment by cheque - this is the most insecure method of payment in international trade and you should avoid it. The main problem is that your bank can refuse to accept the check. Sometimes it is better to lose the sale than to make a sale while not receiving the payment for the goods. Also, when sending the cheque through the international banking system, fees can mount up significantly, making this method very expensive and slow.

- Payment by bank draft – a physical document that is rarely used, as it has been replaced by electronic bank transfer.

- Clean bank transfer – this is a well-known method. The importer pays you, using a banking system, commonly through SWIFT (Society for Worldwide Interbank Financial Telecommunication). It is a safe method only in the case of advance payment (when you get paid before shipping the goods).

- Clean collections – this involves sending financial documents such as bills of exchange or promissory notes through the banking system in order to collect payment from the importer. You should use this method only after establishing a certain level of trust with your buyer, because you can lose control over the goods before getting paid.

- Documentary collections – this method guarantees your physical control of the goods until you get paid. Documents (such as invoice, shipping documents, insurance and the like) are transferred through the banking system. Importers can access the documents only when they comply with the instructions you sent to the collecting bank (Documents against Payment or Documents against Acceptance). This method guarantees your physical control of the goods, but it does not guarantee that you will actually get paid in the end. In the event that the importer does not pay you, you can return or store the products, but this is obviously not an ideal situation.

- Letter of credit - Other than payment in advance, the Letter of Credit is considered the most secure method of payment for you. In this process, the buyers’ bank will only make the payment when the presentation of documents complies with the Letter of Credit conditions. For extra security, the seller can request the advising bank or another bank to confirm the Letter of Credit. In that case, the importer will get goods only after payment. This is also a good way of checking the financial standing of the buyer, as the issuing bank will do a credit adequacy test before opening the Letter of Credit on behalf of the buyer.

Generally, when making the first export shipments, you should first require advance payment and gradually move to the Letter of Credit and finally to the Standby Letter of Credit. A Standby Letter of Credit is opened in case of regular shipments for a whole year. It reduces the cost, because instead of twelve Letters of Credit during the year, you only need to open one Standby Letter of Credit that covers the average volume over the year. This can also be a good solution for deferred payment.

However, this process is related to long-term partnerships and for payments of individual shipments one by one. If you do not know your buyer, you should always insist either on advance payment (to be paid before sending the goods) or a Letter of Credit.

The main disadvantage of a Letter of Credit is that it can be costly. To overcome this problem, you can offer the buyer to split the fees. For example, you can pay the fees of your bank while the importer can pay the fees of his (issuing) bank. Another problem faced by some developing countries is when their banking sector does not offer the possibility of using the ‘Letter of Credit’. This process requires correspondent banks, which some developing countries do not yet have.

When trading with the European buyers, you may be faced with pressure from the importers to use deferred payment. You can accept this condition if you use export insurance services. However, in order to protect suppliers from this common practice, the European Commission has adopted a new directive to protect small and medium-sized suppliers in the food supply chain. The directive aims to protect farmers, processors, distributors, producer organisations and suppliers from outside the European Union.

Tips:

- Ask for advice from Chamber of Commerce to gain a better understanding of the payment methods. You can also purchase several guides and practical documents on trade finance from the International Chamber of Commerce (ICC). Alternately you can enrol in ICC online training or Export Academy’s online training on trade finance.

- Find out the costs and procedures for the Letter of Credit use with your bank. Although the Letter of Credit process may seem complicated, in reality the majority of steps are performed by banks and not by you. You need to follow the bank’s instructions and make sure your documents are correct.

- Select a bank that is recognised in Europe and has daily experience in dealing with Letters of Credit. Ideally, your bank and the bank of your buyer should be part of the subsidiary network of the same bank.

- Establish a clear set of Letter of Credit Instructions tailored to your business model and send it to your potential buyer before signing a contract. This will speed up the time of opening a Letter of Credit for buyers and avoid adding unnecessary terms and conditions.

- Use the support of the Trade Facilitation Programs by international development banks. Examples are the EBRD Trade Facilitation Programmeor the IFC Global Trade Finance Program or the Asian Development Bank’s Trade Finance Program. Those programmes offer a guarantee to cover the costs of transactions. You can access this network through selected local banks in your country who are members of those particular programmes.

2. Do not take risks - insure your export and increase competitiveness

- You submit the request for credit insurance with the necessary documents to ECA.

- ECA sends an indicative offer to you.

- If you agree with the indicative offer, ECA orders credit reports for all buyers that you would like to offer deferred payment terms.

- ECA analyses the buyers’ creditworthiness and sets the credit limits.

- ECA delivers the final offer to you, after which, if you accept, the insurance policy is signed.

Aside from insuring the payment, you should also insure your products. A shipment insurance is used to protect your shipment of products throughout the entire journey from you to your customer. The risks that are covered typically include, for example, theft, damage due to heavy weather and damage due to problems with a vessel. You and the importer will have to agree on who is responsible for the insurance. This is specified in Incoterms (required technically only under CIP/CIF terms). You are advised to agree this type of insurance with your buyer. In this type of insurance, two types of documents are used: Insurance Policy and a Certificate of Insurance.

Tips:

- Find reliable export credit agencies and companies that are part of a larger network. One of the best places is to search the list of members of the Berne Union.

- Ask export credit agencies to give you an offer for the solvency report of your targeted buyers. This will not give you payment guarantees, but you will have a clearer picture of the company you want to make a deal with. In some countries, basic information (such as annual turnover and basic balance sheets) is available free of charge. More insight might make it easier to decide whether or not to work with some clients without credit insurance.

- Read more about risks covering issues related to export credit agencies.

- Ask for advice from experienced exporters about the particularities of working with export credit agencies.

3. Include customs procedures in your cost and time calculation

Generally, the customs procedures follow these three steps:

- Customs pre-alert: spices and herbs entering the European Union must be ‘pre-alerted’. This pre-alert is an electronically submitted alert, normally sent by the carrier or freight forwarder carrying the goods, usually between 2 to 24 hours before the arrival of the goods.

- Inspection and control: this step involves a documentation check and the physical examination of the goods.

- Customs decides on further actions: accept the goods for free trade within the European Union, allow movement into the free zone, allow re-export outside the European Union, destroy the goods or refuse the goods.

When spices and herbs arrive in the European Union, they are inspected and checked by customs authorities. Apart from examining the export documents, examination can involve taking samples for analysis in a customs laboratory. In case of non-compliance with the European Union food safety rules, the product can be rejected, and in some cases, customs authorities may require the physical destruction of the goods.

Rejection of the goods may mean a great profit loss for the developing country exporter. It is therefore extremely important to properly check your spices and herbs, including laboratory testing, before the export. To find more about specific tests or requirements that are relevant for spices and herbs read our study about buyer requirements.

Another important aspect related to customs is the proof of the origin of goods. Most spices and herbs imported from developing countries are imported with lower customs duty or duty free, because this is guaranteed to developing countries within the European Union Generalised System of Preferences (GSP). In addition to GSP, the European Union has a number of specific free trade agreements with different developing countries.

Tips:

- Read the Guidance Document on Customs Formalities on Entry and Importinto the European Union to become familiar with the Union Customs Code.

- Use the Market Access Map to analyse potential competitive advantage based on applied tariffs for your country and other countries. You can learn how to use ‘compare’

- and other functions from instructional MacMap videos.

- Get specific information about the procedures and rules for obtaining a certificate of origin (either Form A or EUR 1 certificate) in your country. Depending on the type of trade agreement between your country and the European Union, specific rules apply. For example, if you are selling a mix of spices, your certificate of origin will be based on proof that at least 50% (or more, depending on the trade agreement) of the value of this mixture is produced within your country.

- Check possible additional costs if your country is on the list of stricter import conditions for specific products. Those usually include obligatory payments for specific laboratory tests for a certain percentage of shipments. When 50% of exported dried chillies must be border controlled, samples of every second container (or track) from that specified country are taken for analyses. Those laboratory costs are usually paid by the exporter.

- Consult your freight forwarder or customs agent about export documents and customs procedure issues. You can search for the agent on the website of the European Freight Forwarders Association or the International Forwarding Association. You can also search for the national associations through the website of the European Association for Forwarding, Transport, Logistics and Customs Services. Alternatively, you can search for the relevant association in your country through the website of the International Federation of Freight Forwarders Associations.

4. Select the best transport and logistics options

One of the trends regarding transport and logistics, is the development of blockchain technology to reduce the costs of intermediaries. An example that illustrates supply chain complexity, is when a simple shipment of refrigerated goods from East Africa to Europe can go through nearly 30 people and organisations, with more than 200 different interactions. Blockchain systems allow each stakeholder in the supply chain to view the progress of goods through the supply chain, monitor the container movement in real time and to see the status of the customs documents.

Tips:

- Go to the websites of the Transport Information Service and Container Handbook for information on the safe storage and transport of spices and herbs. You can also find specific advice on how to secure cargo for road transport in the European best practice guidelines.

- Check the website of the European Logistics Association (ELA) to network with the many different operators within Europe. From ELA, you can also receive training on different topics such as logistics, transportation or warehousing. You can also participate in ELA events.

- Do not hurry when selecting a logistics company. Send your request for a proposal to many operators and be as specific with questions as possible. After you make a short list, make your selection and sign a detailed contract. Your contract needs to involve points such as responsibilities, how damaged goods are dealt with, price changes, compensation and more.

- Find a list of quality-certified ship agents and brokers on the website of FONASBA.

- Monitor the development of blockchain applications in international transport and logistics from the companies such as Maersk, Zim,Provenance or Accenture. Verstegen is an example of a spices and herbs company that introduced a blockchain technology in the nutmeg chain.

5. Ensure safe and cost-effective packaging

- protect the organoleptic and quality characteristics of the product;

- protect the product from bacteriological and other contamination (including contamination from the packaging material itself);

- protect the product from hydration (spices are hygroscopic goods, meaning that they easily absorb moisture from the air);

- not pass on to the product any odour, taste, colour or other foreign characteristics.

- Carton bags

- Jute bags

- High-density Polypropylene bags

- Multi-wall laminated bags

- Waxed, paper-lined tin boxes

- Cloth laminated with polyethylene or polypropylene

- Retail containers are usually made of glass, plastic, tin or aluminium

Polythene should not be used as a packing material, as the flavour components diffuse through it. However, it can be combined with ply fabric bags. To find out more about packaging for specific products, read our product-specific studies.

The European Union has announced the introduction of new legislation concerning plastic packaging, mandating Member States to collect 90% of their plastic throw-away bottles from 2029. Also, some single-use plastics will already be banned from 2021, and the use of other types will be restricted. Items on the banned list include oxo-degradable plastic and expanded polystyrene take-away food and drink containers. By 2030, all bottles in the European Union must be made from at least 30% recycled materials. You must be aware of those requirements and adapt to new export packaging materials in time.

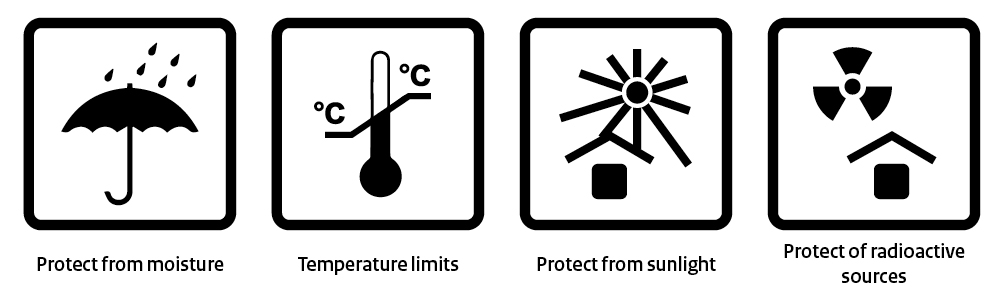

Upon the completion of packing and labelling, you must prepare a packing list. A packing list is an essential document for custom procedures. It will be used by carriers, cargo handlers, warehouses and customers. A packing list states the following particulars for each package: marks, numbers, gross weight in kg, net weight in kg, dimensions in cm, volume and content description. This list also gives the total number of packages and the total gross weight and volume. Depending on the product, certain internationally accepted marks are put on the outside of the packaging. A few examples relevant for processed fruit and vegetables are given in Figure 1.

Figure 1: Examples of marks used on the packaging for spices and herbs

Bear in mind that packed goods must be within the limits of size and weight established by the carrier. The majority of European traders prefer to use pallets with 1,200x800mm dimensions (Euro Pallets). In order to avoid pallets overturning, you must ensure that the cargo is well stabilised. The maximum recommended height of a cargo unit is about 1.7m. Also, pay attention to the forklifts you are using. Electric forklifts are recommended when dealing with food, in order to avoid contamination that might be caused by forklifts powered by fuels.

Aside from the protective role, size and weight also influence the cost of transport. Packing and handling costs are reflected in the final cost of the product. Savings in packaging costs are significant if the container is fully utilised. It is important to emphasise that the time of loading and unloading the containerised goods from a vessel can be reduced by 20-25% if the port has appropriate facilities.

Tips:

- If you are organising your first shipment to Europe, work with an intermediary company that has experience in packaging spices and herbs for export. Big export companies have staff specialised in packaging techniques. A good packaging specialist can save a lot of money for his company if there is a sufficiently large volume of exports.

- Check computer programmes that allow you to calculate and design packaging as well as plan the best arrangement of the goods inside containers and tracks. Those include: ShipHawk, Cube Master, Easy Cargo, packVol and TOPS Pro.

- Check specific packaging requirements for a variety of products on the CBI product fact sheets for spices and herbs.

- Check instructions for shipping and storing of different types of spices and herbs on the website of Transport Information Services.

6. Make detailed contracts

- Names and addresses of the parties.

- Product specification (following internationally accepted standards).

- Quantity (units of measurement in both figures and words).

- Total value (specify the currency, state the price per unit and the total). Agree on a price escalation clause, which ties the price to a certain exchange rate. In addition to this, you can enter into a so-called SWAP transaction with banks, for the purpose of a currency hedge.

- Type of payment such as advance payment or payment deadline.

- Terms of delivery: state the delivery terms, based on one of the Incoterms 2020.

- Taxes, duties and charges: clarify responsibility for all taxes. The prices quoted by the seller may include taxes, duties, and charges. Levies in the import country (if any) may be the buyer's responsibility.

- Delivery: specify the place of dispatch and delivery. Also state whether the period of delivery will run from the date of the contract, from the date of notification of the issue of an irrevocable Letter of Credit, or from the date of receipt of the notice of issuance of the import license by the seller.

- Packaging, labelling, and marking: note all packaging, labelling and marking requirements in the contract.

- Terms of payment and payment security: as explained in the chapter above.

- Insurance: to protect the goods against loss, damage, or destruction during transportation. Specify the type of risk covered and the extent of coverage.

- Documentary requirements: such as the bill of exchange, commercial invoice and other invoices, bill of lading or airway bill, insurance policy, and Letter of Credit.

- Protecting intellectual property: clause if any required under the sale.

- Force majeure: or excuse for non-performance of contract: include provisions in the contract defining the circumstances that would relieve partners of their liability for non-performance of the contract.

- Remedial action: as defaults in contractual obligations by any of the parties can occur, it is always advisable to include certain specific remedial actions in the sale or purchase contract. These remedial actions should reflect the mandatory provisions of the law applicable to the contract.

- Governing law: since trade with foreign partners mostly involves two laws, it is possible to select one of them as the governing law.

- Place of jurisdiction: foreign trade contracts usually include a provision on the place of jurisdiction. The place of jurisdiction defines which court is competent for a possible dispute between the parties.

- Arbitration: as an alternative to legal proceedings before a general jurisdiction court, it is also possible to settle disputes between contracting parties before an arbitration court.

- Inclusion of general terms and conditions: you may agree not to have them.

- Signature of the parties.

Tips:

- For the first contracts, ask the help of a lawyer with experience in international trade issues.

- Be precise in defining your product specification. You can use a general product specification template for food products. More specifically; make use of internationally recognised standards to better define your offer. You should use a product information standard of the European Spice Association. Specifications for individual spices and herbs include standards of Codex Alimentarius and ISO standards for spices, culinary herbs and condiments.

- When claiming specific characteristics of the product, indicate internationally recognised testing methods such as those of the International Standards Organisation and of the American Spice Trade Association. Those can, for example, be related to the determination of moisture in spices, mould in pepper, heat in chillies and colours in sweet paprika or turmeric.

7. Use the assistance of support organisations when organising your export to Europe

- European Spice Association (ESA) – the umbrella association representing the interests of the European spice industry. Many trade-related issues are discussed in the annual meetings. You can download a quality minima document that is relevant for better defining your contract.

- American Spice Trade Federation (ASTA) – represents the United States spices industry. Most guidelines and standards defined by ASTA are also recognised and followed by European buyers. If you become a member of ASTA, you can get support for contracts or arbitration services.

- International Trade Centre (ITC) - a development agency for sustainable trade, with publications such as How to Access Trade Finance, Model Contracts for Small Firms and an SME Trade Academy that provides online courses (some are free of charge), including international transport and logistics.

- EU Trade Helpdesk - a guide to import rules and taxes in the market of the European Union.

- International Chamber of Commerce (ICC) - has worldwide offices and offers arbitration, export learning tools and information about incoterms.

- Your own Chamber of Commerce can provide you with advice and information. Chambers of commerce usually have staff specialised in dealing with issues like transport, trade agreements and legal issues.

English

English